how are property taxes calculated in fl

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. How Are Homestead Property Taxes Calculated In Florida.

Ilhm Luxury Market Report For 07 31 2017 Http Eepurl Com Cx2htd South Florida Real Estate Florida Real Estate Luxury Marketing

Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value.

. Property value is determined by a local tax assessor. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

The median property tax on a 18240000 house is 176928 in Florida. Assessed Value - Exemptions Taxable Value. Your household income location filing status and How Income Taxes Are Calculated.

Dinner Restaurants Near Me Reservations. The median property tax on a 21400000 house is 207580 in Florida. To determine the ad valorem tax multiply the taxable value by the millage rate and divide by 1000.

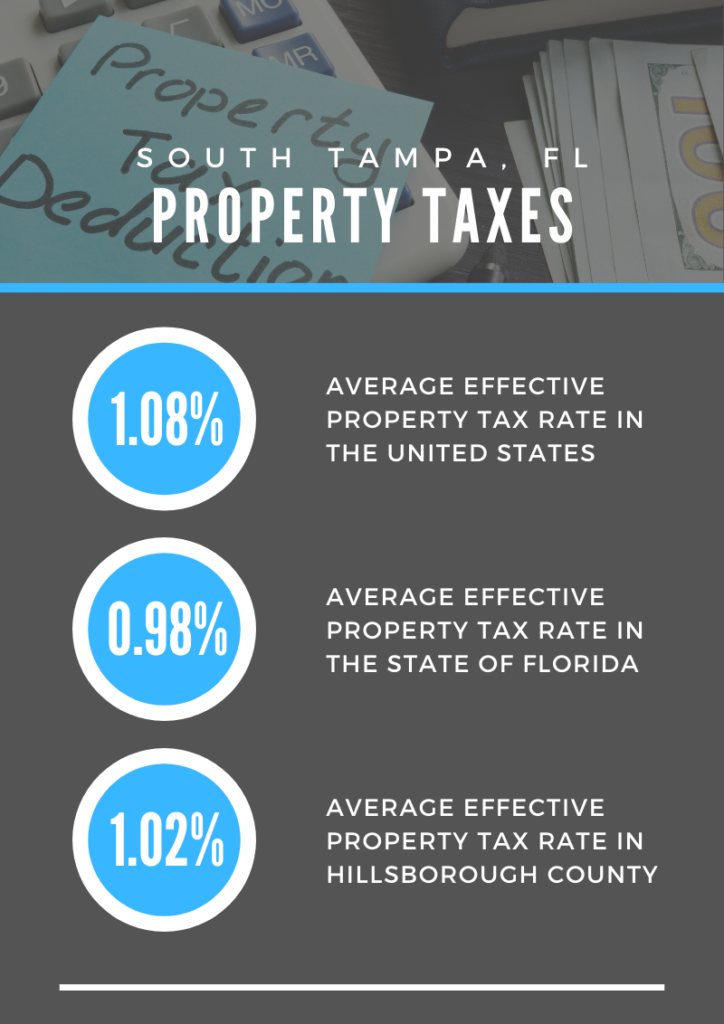

Property taxes make up a portion of your monthly mortgage payment and based on the size and condition of your home they may represent anywhere from a few hundred to a few thousand dollars. Florida property taxes are calculated by calculating the millage rate based on assessed value. Your November tax bill is calculated by multiplying your propertys taxable value by the aggregate millage rate set by the taxing authorities in which your property is located.

HOW ARE FLORIDA PROPERTY TAXES CALCULATED. The total of these two taxes equals your annual property tax amount. The value of a piece of.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Catfish Restaurants In Grove Ok. Taxpayers may choose to pay next years 2019 tangibleproperty taxes quarterly.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. How Is Property Tax Calculated In Texas. How is Florida Property Tax Calculated.

How are property taxes calculated in Orange County Florida. How Are Property Taxes Calculated In Polk County Florida. The median property tax on a 18240000 house is 191520 in the United States.

The median property tax on a 21400000 house is 196880 in Manatee County. County property appraisers assess all. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys taxable value.

Just Value - Assessment Limits Assessed Value. Tax amount varies by county. Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value.

Real Estate Property Taxes A millage rate is the rate per thousand dollars of taxable value. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

In fact state and local governments use various methods to calculate your real property tax base. Sales Tax Reno Nv 2021. Your homes value is 100000 so you will have to pay 1500 a year in property taxes if it is 5.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. How are property taxes calculated in Charlotte County Florida. When it comes to real estate property taxes are almost always based on the value of the land.

Most taxpayers receive their money within 1-2 hours of IRS e-file acceptance. Consequently if you have a 1 income tax rate for example. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes.

Ad valorem taxes are added to the non-ad valorem assessments. Whether you have a 10000 or 1000000 house you will owe real property taxes in Florida. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in.

Every Texas home is assessed a property tax based on its appraised value. Property taxes are determined by multiplying the propertys taxable value by the millage rate set each year by the taxing authorities. 097 of home value.

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property. This simple equation illustrates how to calculate your property taxes. Real property tax rates vary from state to state.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property. Assessed Value Exemptions Taxable Value. Taxable Value x Millage Rate.

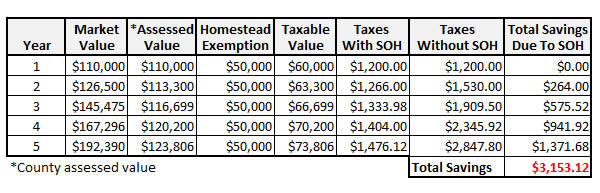

For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of. Calculating South Florida Property Taxes As you create a budget and save up to buy a home in South Florida its important to estimate every cost and fee youll have to pay. How Are Property Taxes Calculated At Closing In Florida.

Click on Add a State. 9 hours agoOur income tax calculator calculates your federal state and local taxes based on several key inputs. The amount of taxes you owe is determined by applying the millage rate to your propertys taxable value.

Florida property taxes are computed on the taxable value To obtain the taxable value determine the assessed value of the home less eligible. Tax rates for real estate are determined by millages. Property values are assessed at a certain millage rate based on the 1000 of estimated tax income.

Add the value of the land and any improvements to determine the total value. Your property tax is calculated by first determining the taxable value. The median property tax on a 21400000 house is 224700 in the United States.

Taxable Value X Millage Rate Total Tax Liability. As the Value limited by the Save Our Homes Cap or 10 Cap equals the value it is called the value shown on the market. The taxable value is your assessed value less any exemptions.

A local millage rate a dollar amount per 1000 of. The rates are expressed as millages ie the actual rates multiplied by 1000. Find the assessed value of the property being taxed.

Italian Restaurants Milwaukee Area. Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value. How are property taxes calculated in Orange County Florida.

February 13 2022. With each subsequent annual assessment your. Taxable value of 100000 x 285 mills 285000.

The assessed value estimates the reasonable market value for your home.

Property Taxes In South Tampa Fl Your South Tampa Home

Florida Property Tax H R Block

Your Guide To Prorated Taxes In A Real Estate Transaction

Florida Real Estate Taxes What You Need To Know

Real Estate Property Tax Constitutional Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

Property Tax Prorations Case Escrow

Property Taxes Calculating State Differences How To Pay

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

What Is Florida County Tangible Personal Property Tax

Florida Dept Of Revenue Property Tax Data Portal

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Cape Coral Florida Condos For Sale Cape Coral